EWNZ: A post from exposenews.com has been corrected as here below. I had shared the original post today. Expose News has provided an apology & correction….

Continue reading Correction: There Is No “Digital Currency Modernization Act”Tag Archives: cashless

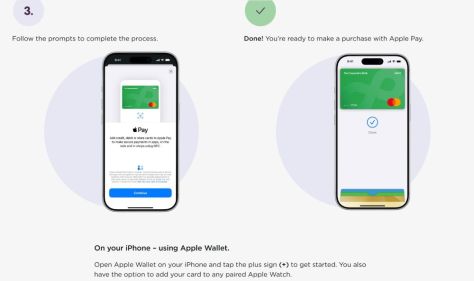

‘Your iPhone is now your Co-operative bank card’ + your passport

A Nokia CEO said at Davos in 2022, cell phones will be built directly into our bodies within a decade. (Davos where the not-elite jet every year ignoring their ‘carbon footprint’ in aircraft piloted by unjabbed pilots). The linked article tells how Schwab’s offsider Yuval Harari describes humans as ‘hackable animals’. Nice. We’ve been hearing it frequently haven’t we as they ramp up the big slide into digital ID? For our convenience of course. Not. We know it is all about control. They are obsessed with tracking and tracing each one of us to the nth degree (those of us left that is). So here we have the Co-operative bank giving you options with your iPhone. Some of you will think, yay this makes banking even easier. Some of you will think, just another step down the slippery slope. Depends whether you are reading lamestream or independent.

Awake Christians will be alerted by the scenario of phones being built into their bodies (witness the scriptures and Revelation 13:17). And even moreso at the recent revelations about who is being targeted by the NZDF in their practice drills.

Join the dots. Remember this article from 2024?

The plan you thought was conspiracy … beginning July 2025

(Controversial document considered fake by some however discussion on that is included. Such info I keep on the back burner so to speak).

Also these 2020 articles below

The NZDF have practiced with international troops as far back as 2015 to ‘quell civil unrest’.

NZ is spending $20 billion on military hardware while 43K remain homeless

EWNZ

The info below can be accessed at the Co-operative bank’s website.

Go here to read about passports:

“Apple Watch and iPhone owners in the United States will now be able to carry a copy of their U.S. passport on their device, which they can then use at TSA checkpoints across more than 250 U.S. airports when traveling domestically.”

“It is important to understand the push for total control through the weaponization of the financial system” – Catherine Austin Fitts

The Solari 60-Day Cash Challenge

Governments are moving quickly to roll out digital ID systems that tie together identity, payments, and access to everyday life. In the United Kingdom, we’re already seeing the push to make digital identification mandatory. Once money is fully digitized, every purchase can be tracked, limited, or even denied.

That’s not some far-off scenario. We all need to be acting now to push back against this agenda, which is why we’re excited to announce that the Solari 60-Day Cash Challenge officially starts this week.

Why a Cash Challenge?

Using cash is one of the simplest, most effective ways to push back against the march toward an all-digital financial system. Over the next 60 days, we invite you to make the deliberate choice to pay with cash as often as possible when buying groceries, coffee, gas, when eating out, or with purchases from any brick-and-mortar merchant.

Beyond using cash whenever possible, we also challenge you to consider taking some of the following actions in the next 60 days to raise awareness about using cash and why it’s important to do so.

More Ways to Take Action in the Next 60 Days

- Spread the word: Send this article by Catherine, The Threat of Financial Transaction Control, to five friends and ask that they join you in the challenge to use cash whenever possible for the next 60 days. Even better would be to post the link and encouragement to use cash on one of your social media accounts to reach more people. Tag us when you do on X and Instagram.

- Take a Deeper Dive: Watch Solari’s briefing on Keeping Cash in Circulation: A Key Tool Against the Digital Control Grid to deepen your understanding of the issues at hand. The briefing, held on June 12, 2025, focused on one of the most powerful strategies we have to push back against the emerging digital control grid: keeping cash in circulation. Financial planner Tim Caban opened the session by framing the critical importance of preserving cash as a cornerstone of financial freedom and privacy. Susan Luschas, Tobi Maier, and Elizabeth Murphy then discussed legislative actions taken in various states to protect and promote the use of cash, as well as strategies that have proven effective for building public and political support. They also provided details on model bills that can raise awareness and build momentum.

- Celebrate Cash on Halloween: If you participate in Halloween, check out our “Cash is King” Halloween initiative. For the past two years, inspired by subscriber Susan Luschas’s example, we have promoted Susan’s idea of creating a “Cash Is King” Halloween. Instead of poisoning trick-or-treaters with candy, Susan hands out dollar bills, placing “Cash Is King: Why Pay with Cash?” stickers on each bill. This has made her house one of the neighborhood’s most popular Halloween destinations, prompting the eager trick-or-treaters to run home and tell their parents about the merits of paying with cash. Discover more about the initiative here.

Join the Movement

Join us! Take the pledge to use cash for the next 60 days. Share your stories, photos, and reasons for choosing cash. Encourage your friends and family to do the same. Together, we can show others how important it is to use and protect cash usage.

Cash is Freedom. Cashless is Control. Let’s keep freedom alive—one purchase at a time.

#CashChallenge

#UseCash

#CashEveryDay

SOURCE

The end of cash is very close – and this is what it means to you (Dr Vernon Coleman)

From Dr Vernon Coleman

via expose-news.com

EWNZ comment – this is definitely looming larger I notice in NZ. Folk unable to deposit cash, directed to the machines to do it. Some businesses won’t take cash, gas stations I’ve heard of also … and the machines have been disappearing with banks also with no word. And online, all manner of intrusions into privacy via questions asked etc. Kiwibank (see below) ‘may ask you why you’re making a payment and who exactly to …

Here’s another from BNZ:

“BNZ has announced significant changes to its range of Advantage credit cards, effective February 2026, that substantially reduce the value proposition for cardholders, per BNZ’s summary. With rewards devaluing by approximately 26%, interest-free days dropping from 55 to 44, and travel insurance benefits being scaled back, many BNZ credit card customers are reconsidering their options beyond what the BNZ is offering. ” Money Hub Newsletter

keeping us all safe of course ….

We are told it is for our benefit – but this is a lie, he says. “They want to get rid of cash for their benefit and not for our benefit. Removing cash will empower the conspirators and remove, forever, the last vestiges of our independence.”

I’ve been warning about the end of cash for at least three decades, and the conspiratorial authorities have been pushing hard for the introduction of digital currencies since the days before laptops and smartphones.

Today, the bankers (aided and abetted by politicians) are closing banks as fast as they can (arguing falsely that everyone wants to bank online), and they’re making it difficult to take cash out of your bank. Automated teller machines (“ATMs”) are rapidly disappearing, and if you try to take cash out of your account over the counter, you could well end up being interrogated like a criminal.

Once the digital currencies become the only way to earn, save or spend, we will all be slaves. The central banks will be able to control our money. They already plan to limit each person to between £10,000 and £20,000. Anything more than that will simply disappear. Negative interest rates will discourage savings. Money will have a limited shelf life – just as money in mobile phones can disappear after a few months. And the bankers will decide how you can spend your money.

It is worth pointing out, by the way, that the central banks have mostly become “independent.” When this happened in the UK in 1997, the Labour Government misled the country, saying that it was giving the Bank of England its independence and granting it operational independence over monetary policy so that it could be free of government influence. In fact, this was rather disingenuous since all central banks were modified to suit the requirements of the financial elites – who prefer to deal with independent banks. In the European Union, it was the Maastricht Treaty which gave independence to the central banks. The European Central Bank, in the EU, is controlled by Deutsche Bank (which was for a long time controlled by Abs, a former Nazi) and other German and European banks. The EU and its Parliament have no control over the bank or its policy. Monetary policy all around the world is controlled by the world’s leading financial institutions. Governments, remember, have no control.

Everyone, it seems, wants to get rid of cash.

First, companies which accept payment by card have to pay commission to the credit card companies. The commission can sometimes be very high with 5% and 7% commission rates not at all uncommon.

Second, clearing banks don’t like cash because handling it is time consuming and, therefore, expensive. Moving money around simply by pressing numbers on a keyboard is much quicker and cheaper (though, curiously, the length of time required to move money from one account to another seems to have lengthened since such methods became available).

Third, governments and government agencies love to see citizens forced to rely on digital money because it is much easier to keep control of what everyone is earning and spending when all money goes through computers. So, for example, in the UK the tax office (HMRC) easily obtained details of what taxi drivers are doing by looking at the records from companies such as Uber. When drivers apply to renew their licences, HMRC sends out threatening letters suggesting that they may have made an under-declaration or no declaration at all.

And, of course, there are all those people who think that using plastic to pay for everything is clever and modern. They don’t realise that plastic cards and chips under their skin are enslaving them and removing the last vestiges of freedom.

Any business which relies on a financial trail (e.g. one that uses an e-commerce site) can now be easily monitored by all government departments. And, of course, it is much easier for banks or the Government to cut off a person’s access to their own money if everything is done digitally. And when all money is digital, banks and other financial institutions will be able to charge what they like. Tax authorities will take what they like from your account.

In the new world of digital money, anyone who shares what is labelled “hate speech” or “misinformation” will be banned from having an account. (It is, of course, already happening.) All those old tweets, and the time you gave a “thumbs down” to the World Economic Forum (“WEF”), will be marked against you.

Remember how American citizens who gave money to the Canadian Truckers had their bank accounts frozen? If you’ve ever criticised your government, then they will make you pay heavily for your impertinence.

Those people who have already lost their PayPal accounts will probably never be allowed to have digital accounts. And without digital accounts, they will starve.

It’s already becoming nigh on impossible to buy petrol without a credit card. And the number of car parks where cash is still accepted is shrinking fast.

Banks throughout the world are preparing to close down all free thinkers. If you think I’m exaggerating, just check out what has already happened.

It has been made clear (by the Bank of England and other clearing banks) that when cash has been replaced with digital currencies, the banks will control how people spend their money. It will be possible to make broad judgements (for example, no one will be able to buy alcohol) and specific ones (patients with early heart trouble will not be allowed to buy certain foods). It will also be possible for governments, banks and companies to monitor spending habits. So, if there is a shortage of eggs, for example, the authorities will be able to make sure that no one buys more eggs than they are allowed.

Removing cash from society will make life incredibly difficult (for which read “impossible”) for those who are not computer literate, for beggars and for charities who rely on cash. The quality of our lives will be massively diminished by the disappearance of cash. And, of course, getting rid of cash can be used to track where we go and what we do.

Many local councils are now forcing motorists to use an App available only on a smartphone to pay for parking, and in those places, it is impossible to pay for a parking place with cash. The information which motorists are forced to give can be used in many ways (and will be sold to a variety of purchasers so, for example, thieves will know when householders are away from their homes). Forcing motorists to use a smartphone in order to park a vehicle is clearly discriminatory (since it means that those without a smartphone cannot park) and almost certainly illegal.

And, of course, people tend to overspend when they use credit or debit cards for everything they buy. Using cash helps keep people out of debt.

It’s vital to remember that they want to get rid of cash for their benefit and not for our benefit. Removing cash will empower the conspirators and remove, forever, the last vestiges of our independence.

We really are close to the end as far as cash is concerned. According to data provider Merchant Machine, cash is now used in only 1% of payments in the most digitalised economies in the world, including Sweden, Denmark, Singapore and the UK. Every time anyone uses a credit or debit card, or flashes a contactless payment card for a small purchase, they are taking us closer to a digital society and digital enslavement.

The end of cash is now just months away.

And when cash disappears, it will take with it the last vestige of our freedom.

The restrictions on what we can and cannot do with our own money get longer by the day. For example, states within the EU will have to collect information on the ownership of luxury goods such as aeroplanes, boats and cars, and each member state will have to establish a “financial intelligence unit.” Rules in England now make it extraordinarily difficult for citizens to access their own money or even to move it from one account to another.

I recently tried to take some of my money out of my account and was shut in a room and interrogated like a criminal before eventually, and rather begrudgingly, being given an envelope containing the cash I’d asked for.

Even moving from one account to another has become fiendishly bewildering and time-consuming.

I was standing in a bank the other day, trying to move money from one account to another. I was moving my money from one of my own accounts to another of my own accounts. I don’t know if you’ve tried doing this recently but it gets harder by the week. You need to produce a driving licence or a passport, of course. (Heaven help you if you don’t have one or the other, or preferably both.) And you need your bank card. And, depending upon the mental state of the cashier, you may need a utility bill, a tax form and a council tax demand. You may soon need a note from your mother.

And, of course, they now have a veritable litany of questions to fire at you. “Has anyone asked you to make this transaction?” “Are you under pressure to do this?” And so on and so on. They pretend the questions are to protect us, but only the naïve and dim-witted believe that. These stupid questions are devised by very wicked people to delay the whole procedure and to force us all to bank online.

One of the daftest questions is this one: “Is anyone waiting outside for you?”

Standing next to me, at the neighbouring window, stood a little old lady – well, in her nineties. She, too, was trying to move money from one account to another so that she could pay a bill.

“Is anyone waiting outside for you?” asked the bank clerk.

“Oh yes,” said the little old lady naively. “My friend brought me.”

The clerk looked as pleased as if she’d won the lottery. “Oh, well, I can’t help you then,” she said with a big smile and a sense of satisfaction you could have bottled.

The little old lady didn’t understand. “But my neighbour had to bring me,” she explained. “I’m 93. I had to give up my driving licence.”

The poor woman didn’t understand that logic and honesty are no longer relevant.

“But your neighbour might have put you under pressure to make this transaction,” said the clerk, brim full of sanctimonious, self-righteous, box-ticking obedience.

“My neighbour?” said the old lady. “Why would she do anything nasty to me? I’ve known her for nearly 50 years.” She looked around, bewildered. “I’ve been banking here for years. Doesn’t anyone recognise me?”

“That doesn’t matter,” said the clerk, her joy now slightly diluted by exasperation. “I can’t help you if you have someone waiting for you. Those are the rules.” And then she added the killer. “It’s for your protection.”

And so the old lady, puzzled and confused, tottered out of the bank and back to her neighbour’s car.

I swear that happened. And I’m not surprised.

(The banks make a great fuss about our responsibilities and their lack of them. But did you know that Barclays Bank has just been fined $361 million by the US Securities and Exchange Commission? And do you know why? Well, they “accidentally” sold $17.7 billion worth of structured financial products for which they did not have authorisation. The total effect on shareholders (including many pensioners), as a result of this $17.7 billion “accident,” was to help push down net income by 19%. The little old lady’s one mistake was that she didn’t tell the clerk to move $17.7 billion that she didn’t have from one account to another. They’d have done that with a smile and probably given her a free pen and a cup of coffee, too. )

Morons (of whom there are many these days) claim, as they have been told, that the inquisition is for our benefit. That’s yet another lie. The banks want to force us online. And, as a side effect, they want to absolve themselves from blame when they screw up (which they do on a regular basis). If you want evidence that the banks have been politicised, just look at the way that people who dare to stand up and question the system lose their bank accounts. In Canada, citizens who stood up in defence of truckers protesting about vaccine mandates lost their bank accounts. And the same thing is happening with frightening regularity everywhere else. In England, the boss of an independent platform carrying free speech videos lost his bank account and found that no other bank would accept him as a customer. No one could tell him what his crime was. Nigel Farage, the well-known politician, was suddenly told that a bank he had been with for 40 years was going to close his accounts – both business and personal. A man who asked why his local building society was festooned with flags celebrating homosexuality found the cost of free speech when the building society responded to his query by closing his account.

Bank staff seem to have been indoctrinated by the same people who indoctrinated NHS staff, train drivers, civil servants, teachers, council employees and just about everyone else in this increasingly miserable and oppressive world of ours.

(Teachers call what they do “brainwashing in a good cause.” But can brainwashing ever be defended? If the evidence for their claims were solid and honest, they would not need to make stuff up or attempt to brainwash their students. For decades now, school teachers have been indoctrinating rather than teaching their pupils, promoting the myth of climate change, changing history to meet woke demands and altering the balance of history to suit their propaganda. And refusing to allow pupils to question or debate the official version of history.)

Taking cash out of your own account has become an exercise in patience and determination.

I recently went into a branch of my bank wanting to take out some money – a little more than the machine would allow me to withdraw. I had bills to pay and I wanted to buy some presents.

“Are you going to take this money home and keep it there?” asked the clerk.

I thought this was an incredibly stupid question. The woman was a stranger, and she had my address on a screen in front of her. She wanted to know if I was going to take money home and keep it there to be stolen. What an idiot. So, I was a little cautious. As any sensible person would, I said “No.”

“So, why do you want this money?” asked the impertinent bank clerk.

“To buy sweets,” I replied. It has been my standard reply to this question for years.

Bang. I could tell from her eyes that the metaphorical shutters had come down.

You can’t make light-hearted comments any more.

The clerk looked at her screen as if it were telling her something.

“Your request has been blocked,” said the clerk.

In full sight of other customers, I was ushered into a room and the door was closed.

And I was interrogated. I felt like a criminal. Most people would, I think, have found it a humiliating and embarrassing encounter.

Phone calls were made. I was instructed to answer questions put to me on the telephone. (I couldn’t understand the questioner’s accent and so I needed a translator.) To check my identity, I was asked for my date of birth (a piece of information that is about as secret as Prince Harry’s level of affection for his brother).

And eventually, after what seemed like several hours of interrogation, I was, with ill grace and no apology, given the amount of money I had requested.

It wasn’t a loan I was asking for. It was my money.

It is, of course, all part of the scheme to force us to bank online – ready for the digital currency they have ready for us.

Your bank hates you. They want to turn you into nothing more than numbers on a computer.

When cash disappears, you will become a slave of the system. You will have no freedom and no independence. The authorities will be able to turn off your access to your own money. You will own nothing and you will not be happy. You’ve been warned.

Note: The above is taken from `Their Terrifying Plan’ by Vernon Coleman. For details of the book, please CLICK HERE.

About the Author

Vernon Coleman, MB ChB DSc, practised medicine for ten years. He has been a full-time professional author for over 30 years. He is a novelist and campaigning writer and has written many non-fiction books. He has written over 100 books which have been translated into 22 languages. On his website, HERE, there are hundreds of articles which are free to read. Since mid-December 2024, Dr. Coleman has also been publishing articles on Substack; you can subscribe to and follow him on Substack HERE.

There are no ads, no fees and no requests for donations on Dr. Coleman’s website or videos. He pays for everything through book sales. If you would like to help finance his work, please consider purchasing a book – there are over 100 books by Vernon Coleman available in print on Amazon.

RELATED:

Important recent post from The Corbett Report on Digital ID

Interview 1986 – Digital Papers, Please! on the IMA Panel

Europe Criminalizes Large Cash Payments Ahead of ‘Digital Euro’ Launch

Canadian Government Quietly Advances Plan for National Digital ID

Photo Credit: Image by Free stock photos from www.rupixen.com from Pixabay

On the apparent banking cyber attack – important info (UPDATING)

Always wise to be awake, aware … and prepared…

I posted elsewhere recently on noticing changes with the banks, one that folk are suddenly finding it harder to get even a small bank loan, compared to months back when they were all too willing to grant credit & money, being the predators that they are. Changes, rumor has it are coming in October. Now I know rumor is not necessarily reliable, however, it can be a heads up & a reminder as I say, to be prepared. Especially given the corruption that is currently rife, and also that our news is being heavily censored, and those speaking out, censured or removed. (See related article from seemorerocks on Chinese bank. EWR

Read at the link:

RELATED: Is this China’s Lehman Bros.?

Also here (adding these as they appear, I don’t necessarily agree with all of it… for your perusal … make your own judgments): https://www.facebook.com/amtvmedia/videos/1024215598154031 (re China)

RNZ podcast: https://tinyurl.com/4sjfts8x (re the cyber attacks)

Photo : halturnerradioshow.com

Is The Globalist “Reset” Failing? The Elites May Have Overplayed Their Hand

By Brandon Smith | Alt-MArket

I have been writing about the threats of globalism and the “reset” for many years now, and I have noted for some time two separate quandaries; one affecting the liberty movement and the other affecting the globalists:

1) First, criminals tend to brag about their crimes when they think that it’s too late for anyone to do anything about them. I predicted the globalists would be very open in revealing their agenda the moment they believed themselves “untouchable”. For the freedom loving public this suggests that in 2020 going into 2021 that the elites must think there is nothing that can be done to stop the machine; they are so blatant in their calls for the global “reset”, a cashless society, totalitarian lockdowns and a surveillance state that no one in their right mind can claim these notions are “conspiracy theory” anymore.

The fact is, the “conspiracy theorists” were RIGHT ALL ALONG, and now there is nothing anyone can say about it.

READ MORE

Image by jacqueline macou from Pixabay

US Printed More Money in One Month Than in Two Centuries

No surprises really. They’ve made it no secret they have a reset planned & they want rid of cash. EWR

From cointelegraph.com

“The United States printed more money in June than in the first two centuries after its founding,” Morehead wrote. “Last month the U.S. budget deficit — $864 billion — was larger than the total debt incurred from 1776 through the end of 1979.”

READ MORE

Image by Thomas Breher from Pixabay

You must be logged in to post a comment.